Navigating the complexities of shipping is essential for success in the retail and e-commerce industries. This comprehensive guide will provide you with valuable insights and information to streamline your shipping processes and ensure customer satisfaction.

Understanding Shipping Costs for Retail & E-commerce

Shipping costs can significantly impact your bottom line. Factors like package dimensions, weight, destination, shipping speed, and carrier choice all play a role in determining shipping costs. It's crucial to understand these factors to accurately calculate shipping expenses and set appropriate pricing for your products.

Choosing the Right Shipping Carrier

Selecting the right shipping carrier is essential for timely and reliable deliveries. Consider factors like shipping speed, cost, tracking capabilities, insurance options, and customer service when evaluating different carriers. Partnering with a reputable carrier can help build trust with your customers and ensure a positive shipping experience.

Packaging and Labeling

Proper packaging and labeling are essential for protecting your products during transit and ensuring they reach customers in good condition. Choose packaging materials that are durable and appropriate for the type of product you're shipping. Ensure your labels are clear, accurate, and include all necessary information, such as the recipient's address, shipping method, and tracking number.

Returns and Exchanges

A clear and customer-friendly return and exchange policy is crucial for building trust and loyalty. Make sure your policy is easily accessible on your website or in your store. Offer convenient return options, such as prepaid return labels or in-store returns.

International Shipping

Expanding your business to international markets can open up new opportunities for growth. However, international shipping involves additional complexities, such as customs regulations, import duties, and longer transit times. Partnering with a freight forwarder or customs broker can help navigate these complexities and ensure smooth international shipments.

Partnering with Experts

Working with experienced logistics providers and e-fulfillment centers can help you streamline your shipping operations and focus on growing your business. These partners can handle tasks like warehousing, order fulfillment, and shipping, allowing you to dedicate more time and resources to other areas of your business.

By following these guidelines and partnering with the right experts, you can turn shipping into a competitive advantage for your retail or ecommerce business.

How to calculate the right shipping costs?

Shipping costs for ecommerce and retail businesses are influenced by a multitude of factors, making it essential to understand the underlying components.

These costs typically encompass packaging materials, carrier fees (which vary based on destination, weight, dimensions, and service level), insurance, and handling expenses.

Businesses can opt for various pricing models, such as flat-rate shipping, real-time carrier rates, or free shipping with conditions. Resources like the Shopify Shipping guide and guides on calculating shipping costs provide valuable insights into optimizing these expenses. Additionally, partnering with shipping carriers or utilizing third-party logistics providers can offer discounted rates and streamlined processes.

Excise goods - ecommerce & retail

Excise goods like alcohol, tobacco, and fuel are subject to special taxes. Shipping them involves additional costs such as excise taxes, customs duties, and handling fees. To save on costs, consolidate shipments and compare quotes from freight forwarders. In the EU, excise duty rates are set at a minimum level, and businesses can claim refunds or use suspension arrangements when shipping within the EU.

Read more on shipping excise goods to consumers via a shop or online in our excise goods shipping guide.

E-commerce - Shipping goods into the EU

The Import One-Stop Shop (IOSS) is a valuable tool for businesses located outside the European Union (EU) selling goods directly to consumers within the EU. It simplifies the collection and payment of value-added tax (VAT) on online orders valued at €150 or less. By registering for IOSS in a single EU member state, sellers can declare and pay VAT through a quarterly electronic return, eliminating the need for customers to face unexpected VAT charges upon delivery. This streamlines the import process, reduces delays, and enhances the customer experience, making it a valuable asset for businesses seeking to expand their reach into the EU market.

| OSS (EU Scheme) | Non-EU OSS (Non-EU Scheme) | IOSS (Import of Goods) | |

|---|---|---|---|

| Types of entrepreneurial services in the EU: | All B2C services within the EU | All B2C services to customers in the EU | Distance sales of imported goods in consignments up to and including 150 euros |

| Distance selling of goods within the EU Article 14a(2) VAT Directive: certain domestic B2C supplies of goods | |||

| Entrepreneurs liable to tax in the EU: | Only businesses established in the EU | Businesses established outside the EU | Businesses established in both the EU and outside the EU, including electronic interfaces (online marketplaces, platforms, etc.) |

| Businesses established in both the EU and outside the EU Electronic interfaces (online marketplaces, platforms, etc.) |

In simpler terms:

- IOSS is like a fast lane for small packages entering the EU from outside. It makes it easier for sellers to pay VAT and for buyers to avoid surprise fees.

- OSS is like a unified tax system for the EU. It simplifies VAT reporting for businesses selling goods and services within the EU, no matter where they're based.

IOSS vs. OSS

| Feature | IOSS (Import One-Stop Shop) | OSS (One-Stop Shop) |

|---|---|---|

| Purpose | Simplifies VAT collection and reporting on imports of goods into the EU up to €150. | Simplifies VAT reporting for sales of goods and services within the EU. |

| Applies to | Goods: Imported from outside the EU and sold to consumers within the EU. | Goods: Sold from one EU country to another. Services: B2C services provided within the EU. |

| Who can use it | Businesses established outside the EU selling to EU consumers. | EU-established businesses and non-EU businesses registered for VAT in the EU. |

| Value limit | €150 or less (per consignment). | No value limit. |

| Registration | In one EU member state. | In one EU member state. |

Compare Logistics Service Providers

Overview of sales taxes in Europe and USA

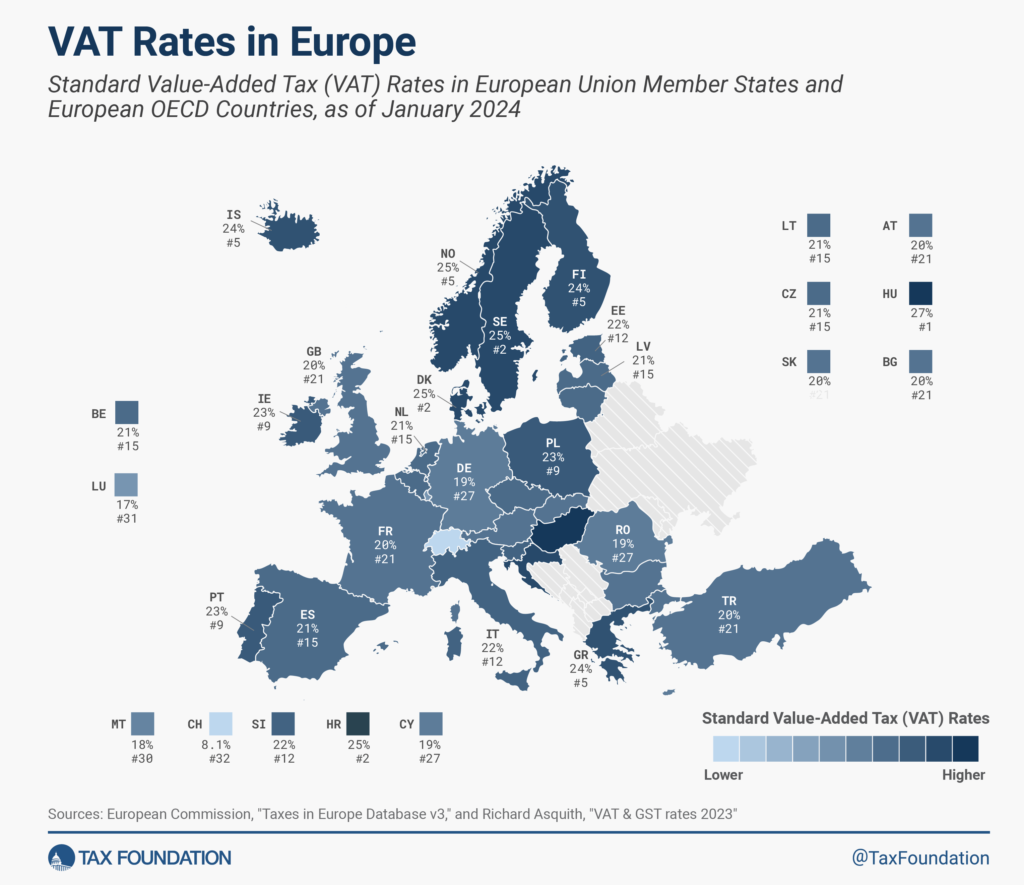

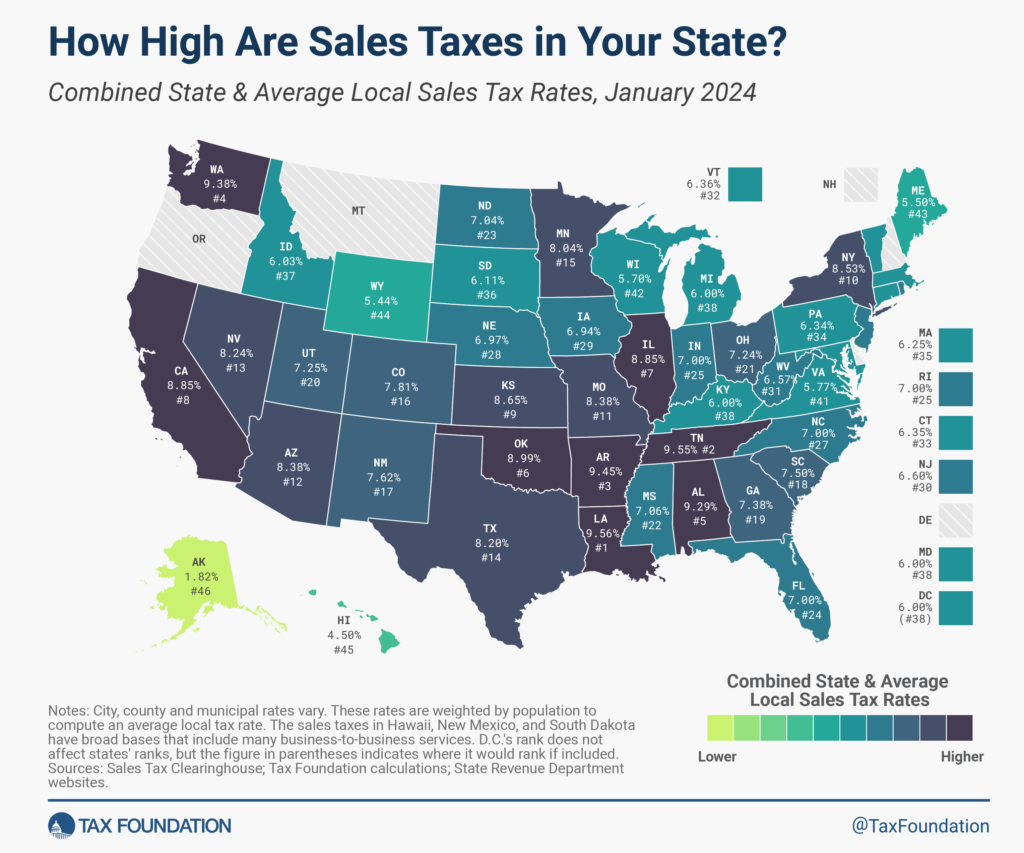

The US operates on a sales tax system, varying by state and even local jurisdictions, while the EU uses Value Added Tax (VAT), a consumption tax applied at each stage of the supply chain. For US shipments, retailers must be aware of nexus, the connection that triggers sales tax obligations in a state. In the EU, VAT rates differ per country, and understanding the complexities of cross-border transactions is vital for accurate tax calculation. Compliance with these regulations ensures smooth operations and avoids legal complications for businesses engaged in international trade.

Looking for a shipping or 3PL solution?

Compare quote from freight forwarders and 3PL parties today!